ICI Viewpoints

Comparing Apples and Pears: EU UCITS and US Mutual Funds

When the European Commission released its proposed EU Retail Investment Strategy (RIS) package, it noted that capital market participation in the European Union has traditionally been lower than in the United States. We sometimes hear that part of the reason for this discrepancy is that UCITS’ average ongoing charges are too high compared with average expense ratios for US mutual funds. For example, in 2021, the asset-weighted average ongoing charge for an equity UCITS fund (1.21 percent) was more than double the asset-weighted average expense ratio for a US-registered equity mutual fund (0.47 percent).

But this comparison is apples and pears (or, for our US audiences, apples and oranges). The UCITS and US mutual fund markets at present have significant underlying differences, such as how investors pay for distribution and advice, markedly different scale, and the higher relative use of index funds by US investors.

Key Point #1: Payments for distribution and advice out of fund assets are not banned in the United States, but competitive pressures have encouraged these payments to largely be externalized for US mutual funds.

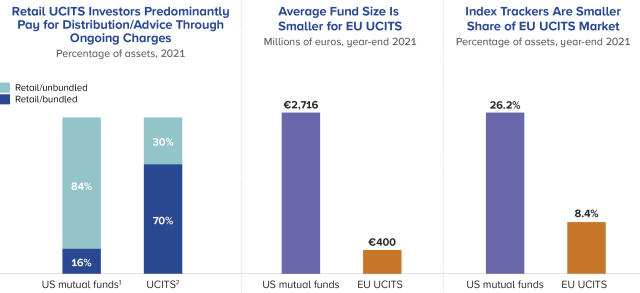

US mutual funds may offer share classes that either bundle the costs of distribution and advice internally or unbundle these costs such that they are paid directly by investors outside the fund (i.e., out of pocket).[1] Over a period of three to four decades, retail investors in US mutual funds have steadily moved away from bundled share classes and toward so-called no-load funds,[2] to the point that in 2021, just 16 percent of retail US mutual fund net assets were in bundled share classes.

Some of this movement can be attributed to “do-it-yourself” investors who invest through discount brokers or directly with fund companies. Another factor is an ongoing shift to compensate financial professionals with asset-based fees outside of mutual funds. Further, 401(k) plans and other retirement accounts in the US primarily offer no-load share classes.

By contrast, UCITS retail investors predominantly pay for distribution and advice internally or through ongoing charges that bundle the cost. In 2021, 70 percent of retail UCITS net assets were in bundled share classes. However, it is important to note that retail investors in UCITS (as well as US mutual funds) may still pay for the cost of distribution and any professional advice in unbundled share classes out of pocket, making it potentially misleading to have a direct comparison between funds that bundle some costs versus those that unbundle these costs.

Key Point #2: US mutual funds benefit from greater economies of scale than UCITS.

Given the scale of the average US mutual fund, it makes sense that their average expense ratios are lower than the average ongoing charges of UCITS. Some relatively fixed costs, including transfer agency fees, accounting and audit fees, and depository fees, contribute proportionately less to a fund’s total ongoing costs as the fund grows. At year-end 2021, the average US mutual fund had €2.7 billion in net assets, compared with €400 million for an average UCITS fund.

The retirement system in the United States provides a channel for mutual funds to achieve such scale. Half of the assets in US defined contribution plans and individual retirement accounts—about $12.6 trillion—were invested in US mutual funds at year-end 2021.

We highlighted in a previous ICI Viewpoints that reducing the frictions between Member States for cross-border UCITS is one way to allow for increased economies of scale in the European market.

Key Point #3: Index tracking funds are a larger share of the US mutual fund market.

In the past decade, US investors have increasingly gravitated toward index tracking funds. At year-end 2021, US index tracking mutual funds were 26 percent of total US mutual fund net assets while index tracking UCITS were 8 percent of total UCITS net assets.

Index tracking funds tend to have below-average ongoing charges because their general approach to replicating the return on a target index lends itself to being less costly, and they are more likely to be sold unbundled from distribution and advice charges.

The fact that index tracking funds tend to be lower cost than actively managed funds does not mean they are more (or less) appropriate for retail investors. Value for money depends on many factors—not cost alone.

Transparency and Competition are the Crucial Elements to Drive Value for Retail Investors

Prescriptive regulations on fund charges, such as the Commission’s proposed cost and performance benchmarks, will not eliminate the underlying factors driving costs in these different markets. By contrast, transparency on costs and charges—coupled with regulations that provide the space for competition not only on costs but also in areas such as services and performance—is a more effective way to allow the market to continue to develop high-quality and cost-efficient opportunities for EU retail investors.

ICI Global supports transparency on costs and charges, and we welcome a discussion on how best to improve investors’ understanding of how they pay for costs such as distribution and advice and to empower investors to choose the approach that is best for their individual needs.

Key Differences Between US and EU Markets Affect Average Ongoing Charges for Funds

1US mutual funds exclude variable annuities and mutual funds that invest primarily in other mutual funds. Mutual funds held as investments in individual retirement accounts, defined contribution retirement plans, 529 plans, and Coverdell education savings accounts are counted as household holdings of mutual funds. Data are as of year-end 2021.

2For this figure, UCITS include funds domiciled in Luxembourg and Ireland and exclude internal funds and funds of hedge funds. Data also exclude institutional share classes. Data are as of the end of each fund’s fiscal year ending in 2021.

Note: All data exclude exchange-traded funds and money market funds.

Sources: Investment Company Institute, Fitz Partners, Morningstar Direct, and Refinitiv

Notes

[1] In the United States, investors in bundled share classes pay for the cost of distribution and advice internally through a front-end load, back-end load, 12b-1 fee, or some combination thereof. Unbundled share classes are those that have a 12b-1 fee equal to zero and do not charge either a front-end or back-end load. For the European Union, we refer to unbundled share classes as those that exclude any fees intended to pay for their distribution.

[2] In the United States, fund share classes with a 12b-1 fee of less than or equal to 0.25 percent and neither a front-end load nor a back-end load are commonly referred to as no-load funds. For more information, see “The Shift to No-Load Funds” in the 2023 Investment Company Fact Book.

Eva Mykolenko is Associate Chief Counsel, Securities Regulation, of ICI Global.

James Duvall is an Economist at ICI.