ICI Viewpoints

Ok, Boomer: Retirement Prospects for Younger Americans Actually Look Bright

Judging by some narratives, you might think that young Americans face a bleak financial future. Whereas Baby Boomers and older generations benefited from a robust economy and outsized investment gains, Gen Z and Millennials have suffered ballooning expenses and other economic headwinds that have curbed their ability to save—or so the story goes.

While it’s true younger generations manage substantial student loan debt while working to establish careers and families, they have also made more progress in retirement saving than prior generations had at the same stage of life. Thanks to the increased prevalence of 401(k)s and other defined contribution (DC) retirement plans offering automatic enrollment and an attractive lineup of diversified investments, the long-term financial outlook for younger generations is promising.

In fact, contrary to the perception that economic conditions have left younger Americans cynical about saving and investing, young retirement savers are bullish about their retirement accounts over the long run. They also strongly support core features of the US retirement system—something that policymakers and academics should keep in mind when contemplating policy changes.

Outpacing Previous Generations

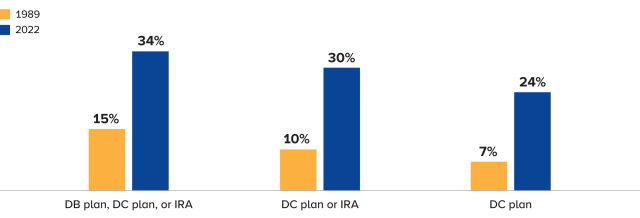

Both retirement account ownership and asset accumulation among younger US households have trended higher in recent decades (Figure 1). Fueled by the prevalence of DC plans, which usually offer employer contributions and have overtaken defined benefit (DB) pensions as the primary type of private-sector workplace retirement plan,[1] the percentage of Gen Z households with DC plan accounts is more than three times that of similar-age Gen X households in 1989.

Figure 1

Young Households More Engaged in Retirement Saving Than Gen X Counterparts Were at Similar Ages

Percentage of households aged 18 to 25 with a retirement account

Note: Age is based on the age of the reference person. Households currently receiving DB plan benefits and households with the promise of future DB plan benefits, whether from private-sector or government employers, are counted in the DB plan category. DC plan assets (401(k), 403(b), 457, thrift, and other DC plans) and assets held in SEP, SAR-SEP, or SIMPLE plans, whether from private-sector or government employers, are counted in the DC plan category. Traditional and Roth individual retirement account assets are counted in the IRA category.

Source: ICI tabulations of Federal Reserve Board Survey of Consumer Finances

Automatic enrollment has also played a role in boosting DC retirement account ownership. Indeed, more than half of DC-owning households younger than 35 in 2023 reported they had been automatically enrolled.[2]

DC plans not only put participants on the path to saving but also often introduce them to investing. Seven in 10 mutual fund–owning households younger than 35 in 2023 report that they purchased their first mutual fund through their employer-sponsored retirement plan.[3]

Along with the improvements in retirement plan design, a burgeoning investing culture and an increased societal push to save early and often have further strengthened Gen Z and Millennials’ retirement fitness.[4]

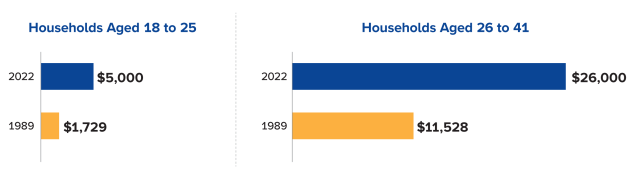

Gen Z households prioritize retirement saving more often than similar-age Gen X households in 1989.[5] In line with that added emphasis, Gen Z households in 2022 had two-and-a-half times more assets in their DC plans—adjusted for inflation—than Gen Xers had in 1989 when they were the same age (Figure 2). The story is similar for Millennial households compared with the same-age cohort in 1989.[6]

Figure 2

Younger Households Have More Saved in DC Plans Than Their Same-Age Counterparts Had Decades Ago

Median DC plan assets, in 2022 US dollars, for households with DC plans

Source: ICI tabulations of Federal Reserve Board Survey of Consumer Finances

Positive Outlook on DC Plans

New ICI research underscores how critical DC plans are to young Americans’ financial future. More than half of DC account owners younger than 35 report that they probably wouldn’t save for retirement if not for their workplace plan.

Additionally, younger DC account owners view these plans favorably for the long term. Among DC account owners under 35 years old, 84 percent agreed that their plan helps them think about the long term, not just their current needs. A similar percentage agreed that saving from every paycheck makes them less worried about the short-term performance of their investments.

Countering the perception that the younger generations are disillusioned with the US retirement system, more than three-quarters of DC account owners under 35 agreed that the tax treatment of their retirement plans is a big incentive to contribute.

Favoring Core Features of Retirement Plans

Because some opinion leaders and policymakers have questioned the public value of the tax deferral that retirement plans receive, survey respondents were asked whether the government should take away these tax incentives. Americans’ views on policy changes—including the views of younger individuals—revealed a strong preference for preserving retirement account features and flexibility. Overall, nearly nine in 10 Americans disagreed with proposals to remove or reduce tax incentives for retirement savings.

Survey respondents also resisted suggestions to change individual investment control in DC accounts, whether while working or in retirement. For example, nearly nine in 10 Americans disagreed with the idea of not allowing individuals to make investment decisions in their DC accounts. About nine in 10 Americans agreed that retirees should be able to make their own decisions about how to manage their retirement assets and income. Roughly three-quarters disagreed that retirees should be required to trade a portion of their retirement accounts for a fair contract promising them income for life.

The Kids Are Alright

The growth of DC plans in the United States has empowered workers of all ages, and Gen Z and Millennials are benefiting from earlier engagement with these plans. Given greater levels of retirement assets and account ownership than prior generations, today’s young generations find themselves well-positioned on the path for long-term financial security. US policymakers can be proud of this progress as they continue supporting young Americans’ bright financial future.

Notes

[1] See US Department of Labor, Private Pension Plan Bulletin Historical Tables and Graphs 1975–2021.

[2] Tabulation from the ICI Annual Mutual Fund Shareholder Tracking Survey.

[4] Regarding the rise of investing culture, see, for example, The Wall Street Journal article, More Americans Than Ever Own Stocks. December 18, 2023.

[5] Based on ICI tabulations of Federal Reserve Board Survey of Consumer Finances, 9 percent of households aged 18 to 25 in 2022 cited retirement as the primary reason for family saving, versus 2 percent of similar-age households in 1989.

[6] Based on ICI tabulations of Federal Reserve Board Survey of Consumer Finances, in 2022, 51 percent of Millennial households had DC plan accounts, compared with 29 percent of their similar-age counterparts in 1989. And 19 percent of households aged 26 to 41 in 2022 cited retirement as the primary reason for family saving, versus 11 percent of similar-age households in 1989.

Michael Bogdan is an Associate Economist at ICI.

Sarah Holden is the Senior Director of Retirement and Investor Research at ICI.

Daniel Schrass is an Economist at ICI.

Jason Seligman is the Senior Economist, Retirement & Investor Research at ICI.